In the realm of real estate and property financing, understanding Mortgage Views is paramount for individuals seeking to purchase or invest in property. It represents a critical aspect of the financial landscape, shaping how individuals secure loans and repay them over time.

Understanding Mortgage Views

What is a Mortgage View?

A Mortgage View is essentially a perspective or approach one adopts when obtaining a loan to purchase property. It primarily involves the interest rate structure and terms applied to the loan, significantly impacting the borrower's financial commitments.

Importance in Real Estate

In the dynamic world of real estate, Mortgage Views play a pivotal role in determining the financial stability and feasibility of property acquisition. They define the financial structure and long-term commitment involved in property ownership.

Types of Mortgage Views

Fixed-Rate Mortgage View

A Fixed-Rate Mortgage View offers stable interest rates throughout the loan tenure, ensuring predictability in monthly payments. This type provides security against market fluctuations but might lack flexibility in certain scenarios.

Adjustable-Rate Mortgage View

An Adjustable-Rate Mortgage View features interest rates that vary based on market conditions. While initially offering lower rates, they are subject to fluctuations, potentially resulting in higher payments over time.

Advantages and Disadvantages

Pros of Mortgage Views

Mortgage Views offer various advantages, such as providing financial predictability (in the case of fixed rates) and potential cost savings (in the case of adjustable rates).

Cons of Mortgage Views

However, they also come with downsides, including the risk of higher payments with adjustable rates and potential limitations in financial planning with fixed rates.

Factors Affecting Mortgage Views

Economic Conditions

Economic fluctuations significantly influence Mortgage Views, impacting interest rates and loan terms.

Credit Score Impact

Individual credit scores play a crucial role in determining the type of Mortgage View one can access and the associated interest rates.

Market Trends

Trends in the real estate market, such as housing demands and supply, also influence Mortgage Views.

How to Choose the Right Mortgage View

Assessing Financial Goals

Understanding personal financial goals is crucial in selecting the most suitable Mortgage View.

Consulting Financial Advisors

Seeking guidance from financial experts assists in making informed decisions aligning with individual financial objectives.

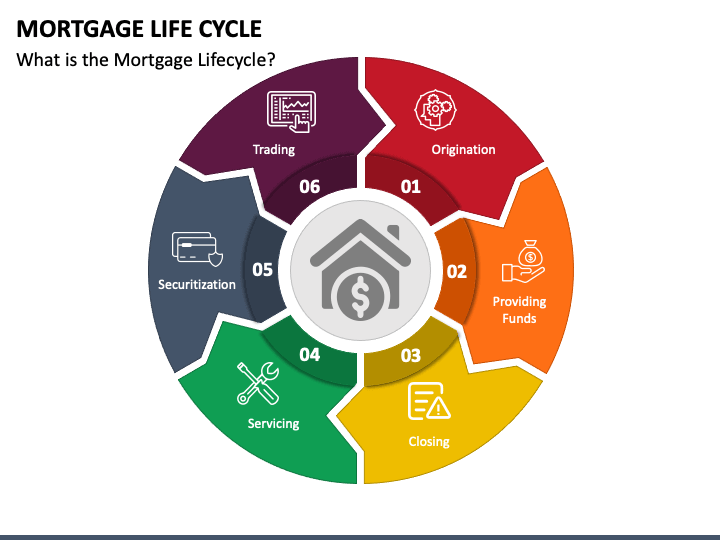

The Application Process

Steps Involved

The application process involves specific steps, including pre-approval, application submission, and final approval.

Documentation Required

Various documents, including income statements, credit reports, and property details, are necessary during the Mortgage View application process.